Last week I posted the first GCC Weekly Index Analysis. Based on some reader feedback, however, I've made some changes to the analysis this week.

In this post I'll explain the modified analysis and how to interpret it. Hopefully this will make things easier to understand and the analysis more useful on an ongoing basis.

The GCC Weekly Index analysis compares each market index their 20-day, 50-day and 100-day moving averages. More specifically, the analysis measures how far the current price level is from each of the moving averages. The change I've made this week is to use to measure the distance that the price is from each moving average in standard deviations (in the previous analysis I used a normalisation method which , upon reflection, wasn't very intuitive to understand) . The bigger the standard deviation (positive or negative) the farther the current price level is from the moving average.

As always, an example makes things clearer:

In the top chart above we have the DFM General Index and the 50-day moving average. As you can see, the price oscillates around the 50-day moving average, sometimes trading above it and sometimes below it. The red line in the bottom chart shows how far away, in standard deviations, the price is from the 50-day moving average. When the price is above the 50-day moving average the number of standard deviations is positive and when it is below the number of standard deviations is negative.

Currently the price is below the 50-day moving average by about -1.9 standard deviations. The standard deviation value can be interpreted as the extent to which prices are stretched above or below the moving average. The greater the standard deviation (positive or negative) the greater price is stretched above or below the moving average.

So, using the method above, the GCC Weekly Index Analysis measures how far current index levels are from their respective 20-day, 50-day and 100-day moving averages. The choice of 20-day, 50-day and 100-day was arbitrary but they are intended to provide a short, medium and long-term perspective of current price action.

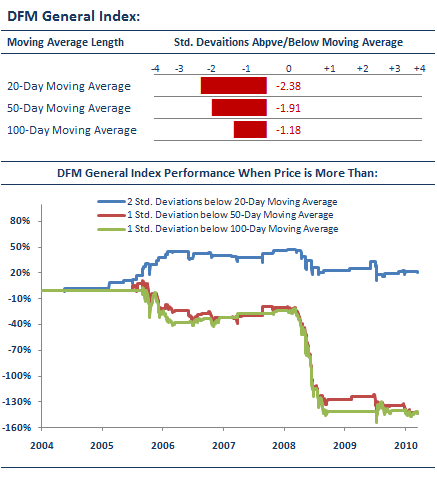

OK, let's look at the current weekly analysis for the DFM General Index.

The top section shows the number of standard deviations the current price of the DFM General Index is from each moving average. In this case, because all three standard deviation measurements are negative, we know the price is below the 20-day, 50-day and 100-day moving averages. We can also see, by virtue of the bigger standard deviation measurement, that the current index level is more stretched versus the 20-day moving average then the 50-day and 100-day moving averages.

Knowing where current index levels are compared to their moving averages is all well and good but how can we use these results? Well, the chart in the analysis above tell us how the DFM General Index performed when similar conditions to the current analysis have occurred in the past. For example, the analysis tells us that the current index level is -2.38 standard deviations below the 20-day moving average. The blue line in the chart above shows the percentage change in the Index when the price has been greater than 2 standard deviations below the 20-day moving average in the past.

Similarly, at current levels the Index is -1.91 standard deviations below the 50-day moving average and the red line in the chart above shows the performance of the Index when it has been greater then 1 standard deviation below the 50-day moving average in the past.

So, using the current standard deviation measurements of price versus moving averages we can build a picture of how the Index has performed in the past under similar conditions. This can provide us with some insight as to what to expect going forward under the assumption that future price action will behave similarly to past price action.

For the DFM General Index when can see from the chart that the Index performance has been generally positive when the price has been greater than 2 standard deviations below the 20-day moving average. However, under similar past conditions for the Index price versus the 50-day and 100-day moving averages performance has been strongly negative.

Based on this we might assume, so long as the current conditions persist, that in the short-term the Index will move slightly higher but over the medium and long-term prices may tend to move lower. Of course, this analysis shouldn't be interpreted as specific trading signals but more of a general guide to probable future price action.

Anyway, I hope this brief explanation has made things a little easier to understand and, in doing so, that the analysis is more useful to you on an ongoing basis.

Enjoy.

skip to main |

skip to sidebar

GCC Equity Market Analysis, Trading Strategies & Performance Metrics

Twitter Updates

Categories

- Abu Dhabi Analysis (1)

- Abu Dhabi Stock Analysis (3)

- Bond Market Analysis (2)

- DFM General Index (4)

- Dubai Analysis (11)

- Dubai Stock Analysis (1)

- GCC Index Analysis (23)

- GCC Trend Analysis (12)

- International (7)

- Kuwait Analysis (1)

- Large Cap Monitor (5)

- Market Breadth (9)

- Market Outlook (5)

- Monthly Index Review (6)

- Moving Averages (1)

- Pattern Matching (3)

- Qatar Analysis (7)

- Relative Strength (3)

- Saudi Analysis (7)

- Saudi Stock Market Analysis (4)

- Seasonality (7)

- Sector Analysis (1)

- Stock Analysis (2)

- Stock Market (1)

- Strategies (1)

- UAE Analysis (4)

- US employment (2)

- US Stocks (2)

- Volatility (1)

- Volume (2)

- Weekly Index Review (19)

Blog Archive

-

▼

2010

(103)

-

▼

August

(27)

- Market Breadth: Part I

- September Seasonality

- Weekly GCC Index Analysis (Week 36)

- Weekly GCC Trend Analysis (Week 36)

- GCC Movers & Shakers

- UPDATE - Saudi Tadawul Index: Watch Out Below?

- Is There A Ramadan Effect?

- DFM Stocks: Year-to-Date & Weekly Returns

- Weekly GCC Index Analysis (Week 35)

- Weekly GCC Trend Analysis....Now Includes Qatar (W...

- Qatar Stocks: Year-to-Date Performance

- Kuwait Stocks: Best & Worst Year-to-Date Performers

- Weekly GCC Index Analysis (Week 34)

- Understanding the Weekly GCC Index Analysis

- DFM Index Approaches Bear Market Lows. Again.

- GCC Weekly Index Performance

- Weekly GCC Trend Analysis

- Saudi Stocks: Best & Worst Year-to-Date Performers

- Saudi Tadawul Index: Watch Out?

- UAE Stocks: Year-to-Date Performance

- Volume: How Low Are Current Levels?

- Weekly GCC Index Analysis

- What Next for the DFM General Index?

- Applying Dual Moving Avarage Strategies to the DFM...

- Why Day Trading Emaar Properties is Very Difficult

- What Can Stock Correlation Levels Tells Us About N...

- Testing the 50/200 Day Moving Average Crossover St...

-

▼

August

(27)

Powered by Blogger.

(c) Copyright 2010 GCC Market Analytics. Designed by Blogger Templates