***** Apologies for the hiatus in posting. I've been with sidelined with a particularly nasty and persistent cold/flu bug for the past couple of weeks. Getting back to normal now though so you can expect regular blog activity. *****

The weekly market analysis pages have been updated for trading week 9 (February 26th - March 4th). Use the links below to view the individual market analysis pages:

The table below shows the market outlook based on each study.

Visit the links above to view the full analysis reports for all GCC markets.

Enjoy.

Saturday 26 February 2011

Weekly Market Analysis (Week 9)

Posted by

Peter Barr

at

17:58

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Weekly Index Review

Bookmark this post: |

Monday 14 February 2011

Divergent Stock Market Performance

US equity markets continue to grind higher. The S&P 500 Index is currently over 23% higher than it was this time last year and new recovery highs seem to be established almost every other trading session.

But the recent strength in US stocks has not been matched by other markets. The charts below show the performance of several major indices over the past year. As you can see, the S&P 500 Index is trading at a yearly high . All other markets, however, are trading well below their highest level over the past year.

I haven't looked into what this divergence in performance may for future stock price direction. But it's interesting, isn't it?

Enjoy.

But the recent strength in US stocks has not been matched by other markets. The charts below show the performance of several major indices over the past year. As you can see, the S&P 500 Index is trading at a yearly high . All other markets, however, are trading well below their highest level over the past year.

I haven't looked into what this divergence in performance may for future stock price direction. But it's interesting, isn't it?

Enjoy.

Posted by

Peter Barr

at

10:51

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

International

Bookmark this post: |

Saturday 12 February 2011

Weekly Market Analysis (Week 7)

The weekly market analysis pages have been updated for trading week 7 (February 12th - February 18th). Use the links below to view the individual market analysis pages:

The table below shows the market outlook based on each study.

Visit the links above to view the full analysis reports for all GCC markets.

Enjoy.

The table below shows the market outlook based on each study.

Visit the links above to view the full analysis reports for all GCC markets.

Enjoy.

Posted by

Peter Barr

at

14:55

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Weekly Index Review

Bookmark this post: |

Friday 4 February 2011

Weekly Market Analysis (Week 6)

The weekly market analysis pages have been updated for trading week 6 (February 5th - February 11th). Use the links below to view the individual market analysis pages:

The table below shows the market outlook based on each study.

Visit the links above to view the full analysis reports for all GCC markets.

Enjoy.

The table below shows the market outlook based on each study.

Visit the links above to view the full analysis reports for all GCC markets.

Enjoy.

Posted by

Peter Barr

at

13:25

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Weekly Index Review

Bookmark this post: |

Thursday 3 February 2011

Qatar Market Retreats From Overbought Levels

In a previous post I looked at how the Qatar market was in overbought territory based upon the 20-day Relative Strength Index (RSI).

Well, since that post the Qatar market has fallen by about 5%, causing the RSI to retreat from those overbought levels.

In the previous post the RSI level for the QE Index was at 80. The updated chart below shows that the RSI has now fallen to 40. That's the biggest RSI decline since the start of the market rally back in the summer of 2010.

In the previous post I also looked at the Qatar stocks with the highest RSI levels. Below are the updated charts for those stocks. Like the QE Index, they have all retreated from their overbought levels - but some more than others.

Enjoy.

Well, since that post the Qatar market has fallen by about 5%, causing the RSI to retreat from those overbought levels.

In the previous post the RSI level for the QE Index was at 80. The updated chart below shows that the RSI has now fallen to 40. That's the biggest RSI decline since the start of the market rally back in the summer of 2010.

In the previous post I also looked at the Qatar stocks with the highest RSI levels. Below are the updated charts for those stocks. Like the QE Index, they have all retreated from their overbought levels - but some more than others.

Enjoy.

Posted by

Peter Barr

at

12:11

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Qatar Analysis

Bookmark this post: |

January Large Cap Monitor

Banks were amongst the big large cap winners in January. Qatar National Bank rose 8.65%, Al Ahli United Bank +7.04% and Emirates NBD +5.43%.

The biggest fallers were Emaar Properties (-14.08%), First Gulf Bank (-10.68%) and Saudi Telecom (-8.69%).

Enjoy.

The biggest fallers were Emaar Properties (-14.08%), First Gulf Bank (-10.68%) and Saudi Telecom (-8.69%).

Enjoy.

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

|

| [ Click to enlarge ] |

Posted by

Peter Barr

at

09:52

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Large Cap Monitor

Bookmark this post: |

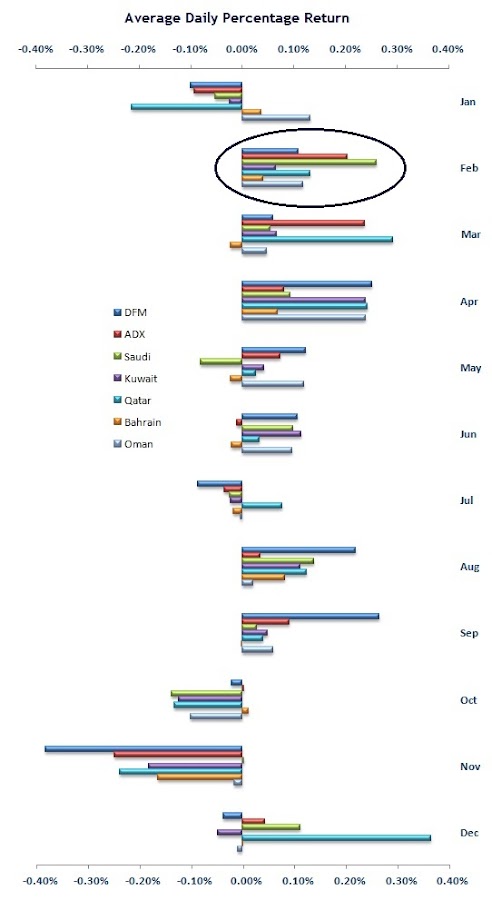

February Seasonality

How have GCC stock markets performed during previous February's?

The chart below shows the average daily percentage change for each GCC market during each calendar month.

As you can see, February has tended to be a good month for GCC stocks with all markets showing a positive average daily return. In fact, from a historical perspective, February through April has been the strongest part of the year for GCC markets.

Here's hoping this February confirms to historical tendencies.

Enjoy.

P.S. It should be noted that we're dealing with a very small data set for this analysis. My data only goes back as far as 2004 for GCC equity markets so there have only been seven prior instances of each calendar month. It's hard to draw any concrete conclusions from such a small data set.

The chart below shows the average daily percentage change for each GCC market during each calendar month.

As you can see, February has tended to be a good month for GCC stocks with all markets showing a positive average daily return. In fact, from a historical perspective, February through April has been the strongest part of the year for GCC markets.

Here's hoping this February confirms to historical tendencies.

Enjoy.

P.S. It should be noted that we're dealing with a very small data set for this analysis. My data only goes back as far as 2004 for GCC equity markets so there have only been seven prior instances of each calendar month. It's hard to draw any concrete conclusions from such a small data set.

Posted by

Peter Barr

at

08:34

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

GCC Index Analysis,

Seasonality

Bookmark this post: |

Tuesday 1 February 2011

GCC Index Performance: January

Everything went a bit wrong in the final few days of January, brought about by the Egypt situation, of course.

The Dubai and Abu Dhabi markets are once again the worst performers with the DFM General Index losing 5.90% in January and the ADX losing 4.89%. Muscat, Bahrain, and Qatar all managed to stay positive for the month, despite suffering late Egypt related falls.

Enjoy.

The Dubai and Abu Dhabi markets are once again the worst performers with the DFM General Index losing 5.90% in January and the ADX losing 4.89%. Muscat, Bahrain, and Qatar all managed to stay positive for the month, despite suffering late Egypt related falls.

Enjoy.

Posted by

Peter Barr

at

10:33

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels:

Monthly Index Review

Bookmark this post: |

Subscribe to:

Posts (Atom)